When it comes to managing payroll, businesses have many options to choose from, and among the biggest names in the industry are ADP and Paychex. ADP offers payroll and HR services for both growing and large businesses locally and internationally. On the other hand, Paychex focuses on providing payroll and HR services for small, medium and large enterprises in the U.S.

Although both payroll solutions can automate and streamline payroll processes such as employee salaries, tax and benefits, each vendor approaches its service delivery differently. In this article, we will dissect each payroll software and compare their payroll service offerings.

ADP vs. Paychex: Comparison table

| Features | ADP | Paychex |

|---|---|---|

| Automated payroll and tax processing | Yes | Yes |

| Multiple payment options | Yes | Yes |

| Employee self-service | Yes | Yes |

| 24/7 human-assisted customer service | No | Yes |

| Integrations | Yes | Yes |

| Mobile application | Yes | Yes |

| Global payroll | Yes | No |

| Pricing | Varies based on the services you pick. | Starts at $39/month + $5/employee |

| Visit ADP | Visit Paychex |

ADP and Paychex pricing

There are noticeable differences in how both platforms approach pricing for their payroll services. ADP offers pricing plans under two categories: 1-49 employees and 50+ employees. For the first category, the pricing plans are Essential Payroll, Enhanced Payroll, Complete Payroll & HR+ and HR Pro Payroll & HR. The pricing plans for the second category are Essential, Enhanced and Premium.

The basic pricing, which is Essential Payroll, is offered for startups and mid-sized companies that need only payroll, taxes and compliance services, while the higher plans offer more capabilities such as garnishment payment services, job posting via ZipRecruiter, background checks, HR tools, live HR support and more.

Although ADP’s multiple pricing plans allow for flexibility, no outright price is placed on them. Customers have to contact their sales team to get a quote.

On the other hand, Paychex offers three distinct pricing plans that all include essential payroll processing and payroll tax administration services. While the Paychex Flex Essentials plan has upfront and transparent pricing, with a base fee of $39 per month and an additional charge of $5 per month for each employee, the Paychex Flex Select and Paychex Flex Pro plans do not. Potential customers have to get in touch with the Paychex sales team to receive a personalized price quote.

Feature comparison: ADP vs. Paychex

Below is a closer look at how each solution stacks up against the other.

Automated tax filing and payments

Tax handling and payment automation are key components that set quality payroll solutions apart from the rest. ADP payroll automates employee payments and tax calculations, ensuring businesses keep up with federal, state and local tax support. ADP’s payroll services are scalable and cover over 140 global destinations.

On the other hand, Paychex also offers automated tax and payments via their Taxpay automatic tax administration service. This service helps businesses automate payroll tax payments and tax calculations and file payroll taxes with appropriate agencies.

Multiple payment options

ADP offers four payment models for their users for enhanced payment flexibility. Businesses can choose from the following payment options: direct deposit, check delivery, print your own checks and paycard.

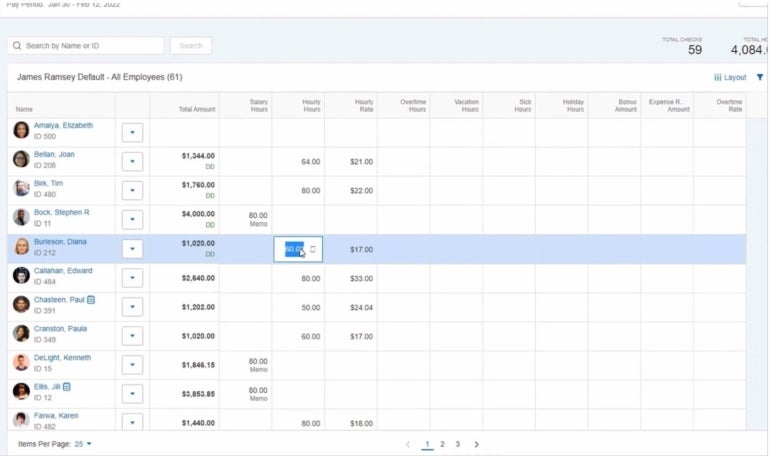

Paychex’s payment options include direct deposit, paycards, paper checks with check signing and insertion, pay-on-demand and real time payments. Although both solutions offer multiple payment options, Paychex provides more choices for their customers.

Employee self-service

ADP’s self-service option can be accessed from desktops and mobile devices. The employee self-service feature allows employees to perform various tasks such as clock in and out, access their pay statements, Forms W-2 and 1099, view and modify personal information, manage deductions, set up direct deposit, view and request time off and approve timesheets.

Paychex self-service options are also available on both mobile devices and desktops. This feature gives employees access to their payroll data, including W-2s and check stubs, and also offers a chat feature between employees and their managers.

Customer support

While ADP provides 24/7 customer support, human-assisted support is only available from Monday-Friday, 7:30 am to 10:00 pm ET. This means that customers only have access to a live chat on weekdays.

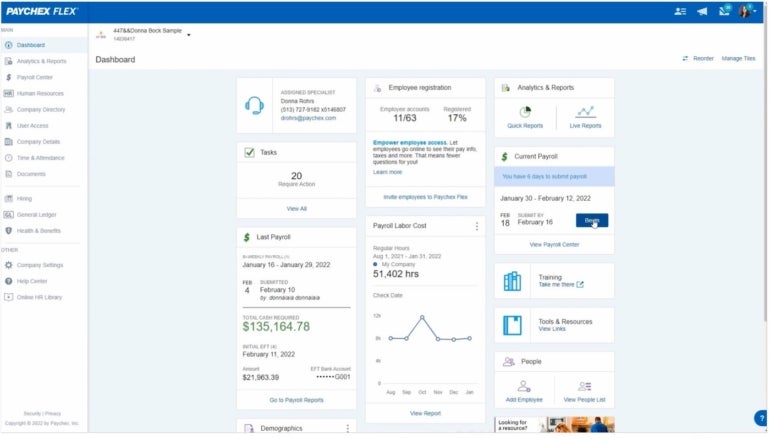

In addition to resolving simple payroll issues by leveraging the Paychex bot engine, customers can get 24/7 human-assisted live support on Paychex.

Integrations

ADP payroll solutions allow customers to integrate with other services. For accounting solutions, businesses can integrate with Quickbooks, Wave and Xero. For enterprise resource planning solutions, users can integrate with FinancialForce, Oracle, Sage and more. For time and attendance, there are 7Shifts, Deputy and Clock Shark.

The Paychex integration feature helps businesses connect with popular HR, productivity and financial tools. Some of the featured integrations include BambooHR, Quickbooks, Workday and Xero.

ADP pros and cons

Below are some pros and cons to consider when choosing ADP.

Pros of ADP

- ADP offers multiple pricing plan options, which allows for flexibility.

- The platform offers customizable reporting features.

- There are a lot of resources for first-time users to learn how to use the product.

- It has great employee self-service.

- ADP offers extensive integration options.

Cons of ADP

- Pricing is non-transparent.

- ADP can be expensive, especially for small businesses.

- There is no free trial.

- First-timers could struggle with the product due to its extensive features.

Paychex pros and cons

Here are some pros and cons to consider when choosing Paychex.

Pros of Paychex

- Paychex offers robust integrations.

- 24/7 human-assisted customer support.

- Paychex offers great employee onboarding tools.

- The platform provides integrations with popular business management tools.

Cons of Paychex

- Payroll is limited to the U.S.

- There is no free trial.

- Only the basic plan comes with transparent pricing.

Methodology

To compare ADP and Paychex’s payroll solutions, we analyzed their key features and benefits such as automated payroll processing, tax compliance, employee self-service, integrations and customer support services. We also considered factors such as pricing, customization options and overall reputation within the industry.

Should your organization use ADP or Paychex?

When it comes to ADP vs Paychex, there is no clear winner. Both vendors offer robust payroll solutions that can help businesses manage their payroll processes more efficiently. Choosing one platform over the other will depend on a number of factors, including the size of the business, the complexity of the payroll process, the payroll budget and the specific needs of the business.

ADP is more expensive than Paychex and, as a result, more suitable for growing and large enterprises. Paychex, on the other hand, is ideal for smaller and mid-sized business owners. For instance, Paychex’s basic plan can easily accommodate businesses with 1-19 employees.

In addition, if your business employs globally, adopting ADP will be more suitable as it operates in over 140 countries.

For businesses that need transparency in pricing before adopting a tool, Paychex can be a better option, despite not displaying prices on all the plans.

If 24/7 human-assisted support is one of the major criteria for choosing a software vendor for your organization, Paychex should be your option. Your organization can easily reach out during work and off hours to discuss your challenges with a human instead of a robot.

In conclusion, we recommend that you carefully evaluate both options before choosing the payroll software that best meets your needs and budget.