Payroll management can be tough, but it doesn’t have to be if you choose the right payroll software. Such solutions are designed to streamline employee payments by automating repetitive tasks, minimizing payroll errors and preventing missed payments. On this page, we compare two of the leading payroll solutions on the market – Square Payroll and Gusto. We highlight their pros, cons, pricing and standout features to help you decide which application fits your organization better.

Jump to:

- Square Payroll vs. Gusto: Comparison table

- Square Payroll and Gusto pricing

- Feature comparison: Square Payroll vs. Gusto

- Square Payroll pros and cons

- Gusto pros and cons

- Should your organization use Square Payroll or Gusto?

Square Payroll vs. Gusto: Comparison

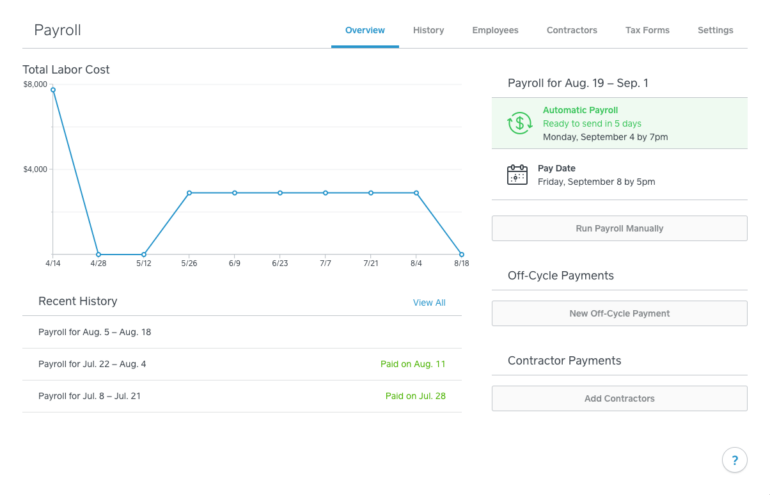

Square Payroll is a full-service payroll solution that is loaded with features including direct deposit, wage garnishments, automatic tax filing and benefits administration. It can integrate with several third-party applications and Square software, including Square POS, accounting software, employee management and more. Square Payroll offers the functionality to manage payroll for salaried employees, hourly workers and contractors.

SEE: Small businesses might like to know about the top payroll processing services of 2023.

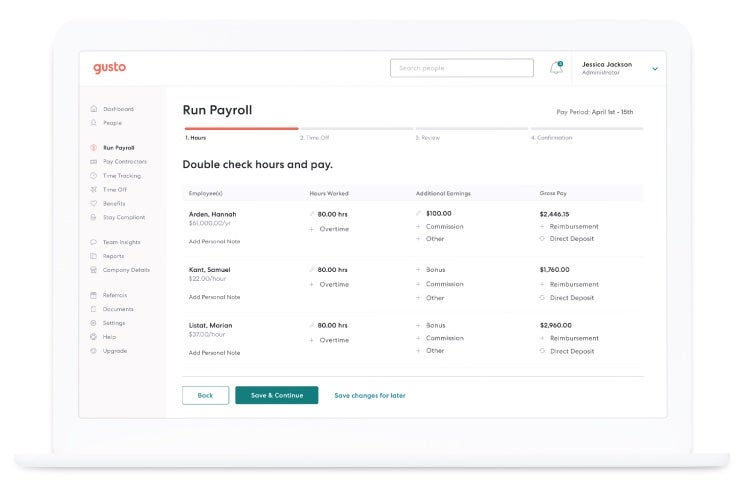

Gusto, previously known as ZenPayroll, is one of the most popular payroll solutions on the market. It offers a solid set of payroll tools coupled with an intuitive user interface. The standout features of Gusto include automated payroll management and attendance reporting, With the higher-priced plans, you get premium support, including expert guidance on taxes and compliance.

Square Payroll vs. Gusto: Comparison table

| Features | Square | Gusto |

|---|---|---|

| Unlimited payroll runs | Yes | Yes |

| Automated tax filing | Yes | Yes |

| Employee portal | Yes | Yes |

| Free trial | Yes | Yes |

| Run payroll via mobile app | Yes | No |

| International payroll | No | No |

| Lifetime access for employees | No | Yes |

| Prepaid debit card | Yes | Yes |

| Starting price | $29 per month plus $5 per employee | $40 per month plus $6 per employee |

Square Payroll and Gusto pricing

Square Payroll offers an all-inclusive flat pricing structure starting at $29 per month plus $5 for every employee. If you only pay contractors, you only have to pay $5 per contractor with no fixed fee.

With Gusto, you get a Simple plan starting at $40 per month plus $6 per month per employee and the Plus plan with $60 per month plus $9 per month per employee. With the Simple plan, you get automatic payroll and benefits integrations. The Plus plan has more comprehensive payroll, benefits and HR tools such as multi-state payroll, premium support and next-day direct deposit. There is also a Premium plan with customized pricing.

Feature comparison: Square Payroll vs. Gusto

Unlimited payroll runs

Both Square Payroll and Gusto offer unlimited payroll runs. This means for the flat monthly fee, you can run payroll without any extra cost. Some competitors have a per-payroll pricing model, which can get expensive for organizations that need frequent payroll runs.

Automatic tax filing

All federal, state and local payroll taxes get calculated, filed and paid automatically with Square Payroll and Gusto. Both the software will file W2 and 1099s and send them to the employees and contractors.

Employee portal

Both Square Payroll and Gusto offer an impressive employee portal that can be accessed through the web or via a mobile app. With Square Payroll, you get the advantage of being able to run payroll through the mobile app.

International payroll

If you need software for international payroll, you will have to look elsewhere. Square Payroll and Gusto do not support payroll for a global workforce. Consider integrating with a third-party application or use Papaya Global if you need software with native capabilities for international payroll.

Lifetime access

With Gusto, employees get lifetime access to their pay stubs, tax documents and the Gusto Wallet, which provides banking services such as high-yield savings accounts.

Integrations

Gusto offers more integrations compared to Square Payroll. While you get deep integration with Square POS, Square Appointments and other Square products, there is a limited scope of integrations with third-party applications for Square Payroll.

Square Payroll pros and cons

Pros of Square Payroll

- Excellent automation tools.

- Cheaper than Gusto.

- Separate payroll for contractors.

- Deep integration with other Square applications.

- Straightforward pricing.

Cons of Square Payroll

- Limited to four pre-scheduled payrolls.

- Fewer advanced features compared to Gusto.

Gusto pros and cons

Pros of Gusto

- Multiple plans to suit the needs of different organizations.

- Intuitive user interface.

- Integrated free checking and savings account for employees.

Cons of Gusto

- More expensive compared to Square Payroll.

- Limited reporting features.

Methodology

To compare Square Payroll and Gusto, we looked at a variety of parameters, including pricing, usability, core features, advanced tools and access to customer support. We also analyzed the pros and cons of each software platform. The comparison was based on hands-on use, user ratings and expert reviews from reputable sources.

SEE: It pays to be choosy with this guide to selecting a payroll service.

Should your organization use Square Payroll or Gusto?

If you already use Square products, then Square Payroll is easily the better option for your organization as it will provide a comprehensive HR solution. However, if that is not the case, then the choice depends on your priorities. Gusto offers clear advantages, including more integrations, a more intuitive user interface, superior customization and multiple plans. With Square Payroll, you get cheaper plans, so if cost is a top priority, you may find Square Payroll is a better option for your organization.