Paycor and ADP are two popular payroll and HR software solutions with similar paycheck, benefits administration, and time and attendance tools. Paycor’s comprehensive but small-scale human capital management solution mainly accommodates small and midsize businesses. ADP’s varied products — which include HR and payroll software, HCM, global payroll and more — work better for big businesses and corporations.

SEE: A guiding hand is available if you need to choose a suitable payroll service.

Jump to:

- What is ADP?

- What is Paycor?

- ADP vs. Paycor: Feature comparison table

- ADP and Paycor pricing

- Feature comparison: ADP vs. Paycor

- ADP pros and cons

- Paycor pros and cons

- Methodology

- Should your organization use ADP or Paycor?

What is ADP?

ADP is one of the world’s foremost outsourced payroll and HR solutions. Its payroll and HR software, RUN Powered by ADP, compares favorably to competitors like Gusto, QuickBooks Payroll and Paycor. ADP also has several outsourced, cloud-based solutions for businesses that want higher levels of third-party HR and payroll assistance. This article focuses on RUN Powered by ADP, the ADP product with the most similarities to Paycor. Learn more in our comprehensive ADP review.

What is Paycor?

Paycor is a human capital management solution, which means it bundles payroll features with HR, talent management, expense tracking, benefits administration, employee experience and workforce management tools. Unlike ADP, Paycor offers a series of solutions tailored to niche industries, including payroll for nonprofits, manufacturing businesses and healthcare industries. Paycor can help you decide which payroll features your business needs and perform a white-glove software setup.

ADP vs. Paycor: Feature comparison table

Both ADP and Paycor offer full-service payroll, benefits administration, HR tools and more. Compare their most crucial features below.

| Features | RUN Powered by ADP | Paycor |

|---|---|---|

| Unlimited payroll runs | Yes | Yes |

| Automatic tax filing | Yes | Yes |

| End-of-year tax forms | Yes (additional fee) | Yes |

| Direct deposit | Yes | Yes |

| Health benefits | Yes (available in all 50 states) | No (third-party insurance integration only) |

| Native time and attendance tools | Yes | Yes |

| Learning management system | No | Yes |

| Mobile app | Yes (for employers and employees) | Yes (for employees only) |

| Clear pricing listed online | No | No |

| Free trial | Yes (Current offer: four months) | Unlisted on site |

ADP and Paycor pricing

Both ADP and Paycor have multiple plans with an increasing number of features, but neither provider lists its prices online. To get a quote, you’ll have to call a sales representative directly.

Feature comparison: ADP vs. Paycor

Standard payroll features

As full-service payroll providers, both ADP and Paycor offer some of the same standard payroll features with little to no difference:

- Unlimited automatic payroll runs.

- Payroll tax calculation, withholding and remittance.

- Year-end tax form generation (additional fee with ADP).

- Direct deposit and check writing.

- Native time and attendance tracking (additional fee for both providers).

Health benefits

ADP has an in-house insurance brokerage that companies can use to find group health insurance plans for employees in all 50 states. While Paycor has an employee benefits administration module, it doesn’t have a brokerage that pairs you directly with insurance companies.

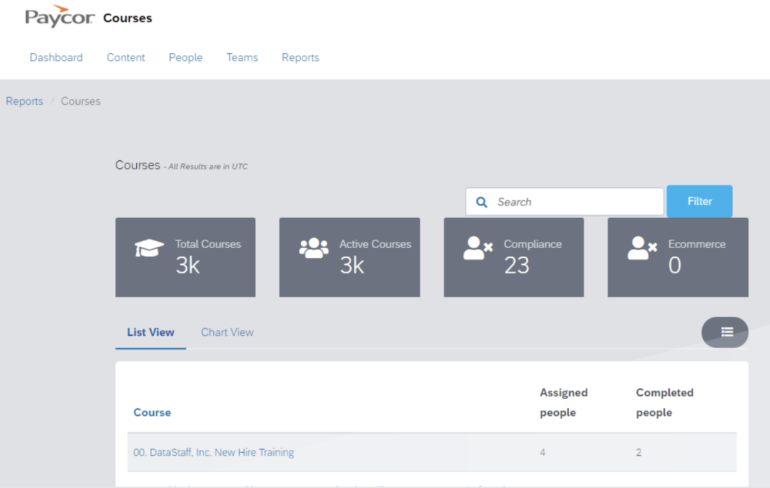

Learning management system

Paycor’s employee learning and development solution lets you customize courses, generate reports and create role-specific lessons that foster career growth. RUN Powered by ADP has basic onboarding features, but you can only use ADP’s learning management system if you choose its PEO plan, ADP TotalSource.

Global payroll

ADP offers several global payroll, HR, talent management and workforce management solutions. While Paycor partners and integrates with a third-party global employer of record called Globalization Partners, it doesn’t have a built-in global payroll system.

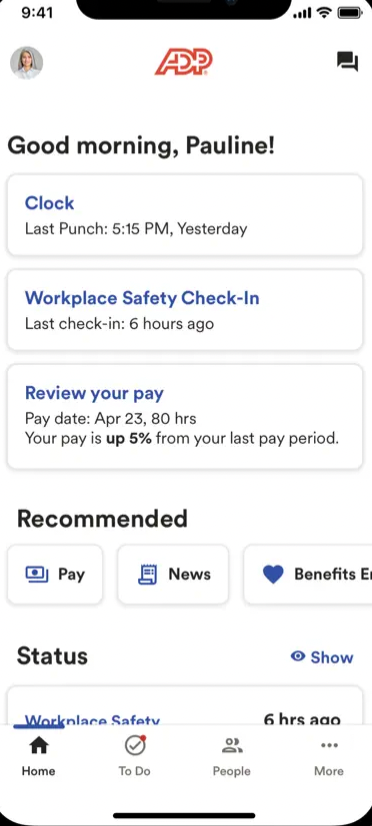

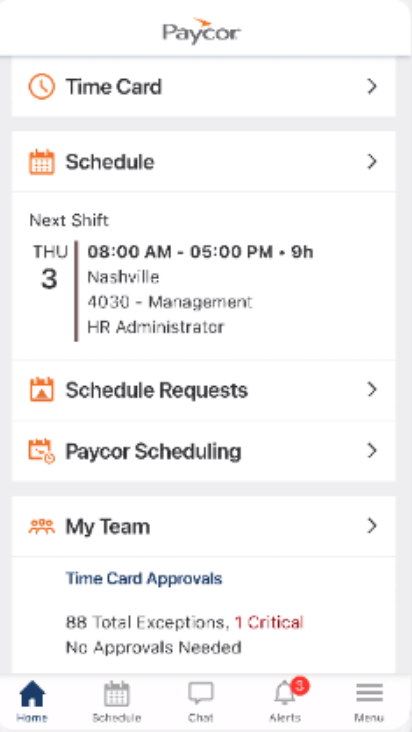

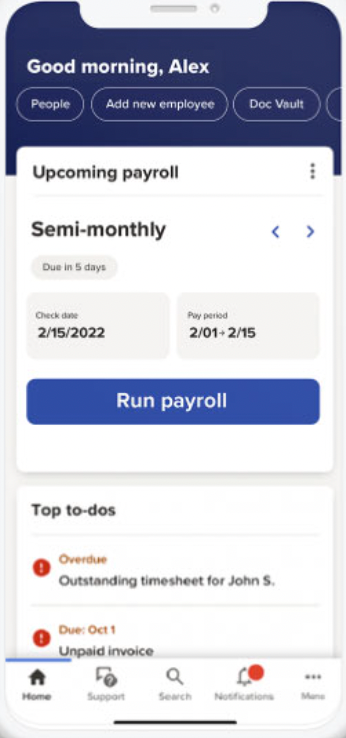

Mobile apps for both employers and employees

Most payroll providers — ADP and Paycor included — have mobile payroll apps your employees can use to access pay stubs, paycheck data and tax forms. Paycor’s app (Paycor Mobile) and ADP’s app (ADP Mobile Solutions) also let employees clock in and out, request time off, view work schedules and see benefits.

Of the two payroll providers, only ADP offers a separate payroll app for employers. The employer-facing app, called ADP Run, lets employers view employee hours, approve payroll and run payroll on the go.

Industry-specific software customization

Businesses in any industry can use ADP to run payroll and handle HR, but its features are fairly generic. If you prefer an industry-specific solution, Paycor’s software can be tailored to businesses in the following fields:

- Healthcare.

- Retail.

- Manufacturing.

- Restaurants.

- Education.

- Non-profits.

- Professional services.

ADP pros and cons

ADP pros

- Multiple payroll plans and products.

- Background checks, new hire self-onboarding and state new hire reporting.

- General ledger report available with every plan.

ADP cons

- Limited pricing information is available online.

- Automated phone-based customer support involves a long phone tree.

- Pricier than payroll-first competitors like QuickBooks Payroll.

Paycor pros and cons

Paycor pros

- Multiple plans to fit multiple business sizes and HR needs.

- Expansive human capital management that is specific to small businesses.

- Thorough career and compensation planning, talent development and recruiting tools.

Paycor cons

- No payroll app for employers.

- No general ledger report is available with the most basic plan.

- Too few features for larger, more complex organizations.

SEE: Rivalry is in the air with this insightful look at ADP vs Gusto.

Methodology

To compare ADP and Paycor, we ran demos for both products and read user reviews on sites like Trustpilot and Gartner Peer Insights. We considered each company’s responsiveness to customer complaints, including those filed with the BBB and detailed on the App Store and Google Play.

Should your organization use ADP or Paycor?

While deciding if ADP or Paycor is right for you, consider factors like price, payroll features, add-on tools, third-party integrations and customer support. You should also consider your business’s size and plans for growth. Companies with fewer than 50 employees won’t need as many features or as much customer support as companies that pay 100 to 1,000 workers.

To get a better sense of just how many payroll options are available to you, read our list of the year’s best payroll software.